How The Jai-Veeru Of The Insurtech Sector Came Together To Build And Scale Onsurity To 70,000 Families

If scaling an Insurtech startup had nothing to do with trust, it would be astonishingly easy to scale in this sector. Yet the founder’s task – his most difficult task – is always that of winning the customers trust. Thus, trust is the “IT” factor. Consequently, one has to keep it in mind, while wishing to scale any startup especially one in the Insurtech sector.

The Growing Insurtech Startup Field

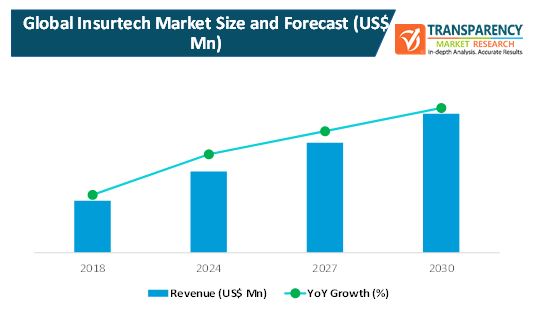

In recent times, we have seen a huge boom in the Insurtech startup field with more and more startups emerging, scaling and further promising the best service to the customers, thus scaling to new heights.

Consequently new Insurtech players now offer all critical 360-degree support and a marketplace to compare policies and prices.

Also, some of these companies have become fully-digital general insurance companies. Additionally many also offer rewards to insurers on being fit. Also in Asia alone, the funding of the Insurtech start-ups has seen a significant boom. According to CB insights, in the past three years the Insurtech funding has tripled in Asia from $140 million to $506 million! Also, India is no exception.

Therefore there is a huge scope for future growth in this sector in line with the medium-term economic growth prospects of the country and the large base of non-insured citizens. This can be verified by the data that is available. According to IRDAI’s annual report, insurance penetration in India stands at 3.69 per cent. Therefore making it one of the lowest across the world.

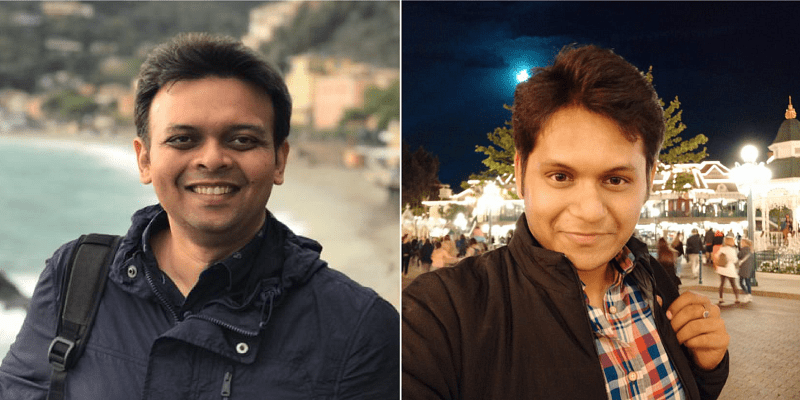

One aspect that can be the deciding factor for customers to choose an Insurtech startup over the other is trust. Founded by Yogesh Agarwal and Kulin Shah, Onsurity is one such startup. Onsurity has and continues to scale to new heights by promising trust and enabling SMEs to provide good quality healthcare to their employees.

Jai-Veeru Of The Insurtech Space!

Yogesh and Kulin can be called the Jai-Veeru of the Insurtech start-up space. The two met at ACKO, a private sector general insurance company. And since then, the two have a strong entrepreneurial bond which led them to start Onsurity in early 2020, with the primary goal being enable to allow SME’s to provide their employees with proper healthcare facilities. So In May 2020, Onsurity launched India’s first healthcare membership. This runs on a monthly subscription, which enables SMEs to provide health care support to their employees.

One, having spent 14 years working in the startup ecosystem and the other being the youngest one to clear the actuarial exam, this duo is the prefect combo. Listen to Yogesh and Kulin from Onsurity talk to Krishna Jonnakadla from Maharajas of Scale, about building and scaling an Insurtech startup, the challenges that come with it and much more on this episode of Maharajas of Scale Podcast.

Here Are Some Excerpts From The Episode:

Yogesh on Starting Onsurity

And then with that, we launched our product, which we named as Onsurity healthcare membership, somewhere in May 2020. It was like an India’s first healthcare membership, which runs on a monthly subscription.

Yogesh 06:25

Listen to Deep Bajaj of PeeBuddy Talk About Scaling a Women’s Healthcare Startup

Spark Behind Starting Onsurity

You know, we need to take care of our people right, because you know, this was a time when we really became humans, in a lot ways.

Kulin 59:52

Show Notes

Check Out Onsurity (onsurity.com)

Yogesh Agarwal On LinkedIn (@yogesh-actuary)

Kulin Shah On LinkedIn (@kcshah)

Follow Maharajas of Scale On Twitter (@maharajaofscale)

Check out the Word Cloud for the Episode below!