SaaS : SaaS Startup Success as a Service

Is one exit of $17 Billion (Flipkart) good or 300 exits of $50 Million good? In case you are wondering if this is a trick question, the answer is no. If you think it’s the one $17 Billion exit, you’re wrong! We think that it should be both. We need both . Now, let us ask a different question. What do you think about SaaS? If you thought SaaS is boring, think again! Prasanna runs Upekkha and he calls Upekkha a catalyst. He might have as well defined SaaS as Startup Success as a Service. Why? Because that is what he seems to be doing at Upekkha. Listen to Prasanna talk about how SaaS is the future of innovation, employment, wealth creation in India and his unique approach at Upekkha.

Prasanna is a speaker unlike any other who may have heard before. A person with strong views and insights, he is putting his money where his mouth and is enabling the next 1000 multi million $ SaaS startups come out of India. And he is playing a huge role around that. Listen to him talk about the Indian SaaS scene and also the playbook and the companies you should watch out for in the SaaS Startup scene attaining success.

Here are some excerpts from this episode:

If a stakeholder is only looking at their piece of the equity, and that part is a zero sum game, then it doesn’t work out well, in terms of alignment, right. So first, we don’t put any funds per se.

0:08:04

So let’s say you’re an entrepreneur, and you’re building a printing machine, and the machine can print $1 of profit. And to build that machine, you borrow $1. Now, if you borrow $1, and it prints $1, of profit, who does that machine belong to?

Let’s say you’re, again, an entrepreneur, and you built a machine which can print $6 of profit, or $10 of profit. And again, you’re borrowing $1 to print build that machine. So which one is a better entrepreneur?

00:11:38

Listen to Another Entrepreneur Talk About His Scale Journey and Entrepreneurship

A lot of founders the mistake that they make (first time founders) is they take too much capital before they’ve proven to sell and they’ve diluted too much let’s say they’ve diluted 30%-40% you know and in India there are lot of sharks, so they might have even diluted 50%.

By the time they get to this hundred K, right, and the problem there is even if they then built that printing machine that prints $10. Yeah, right. They don’t own a lot of it.

So then the economics of the whole thing, go bad, right? So we think about product market fit as, can you build that scalable, sustainable machine, where you have a lot of ownership, because, for us, actually, the goal is financial outcome for founders, not just like financial outcome for the business.

00:15:21

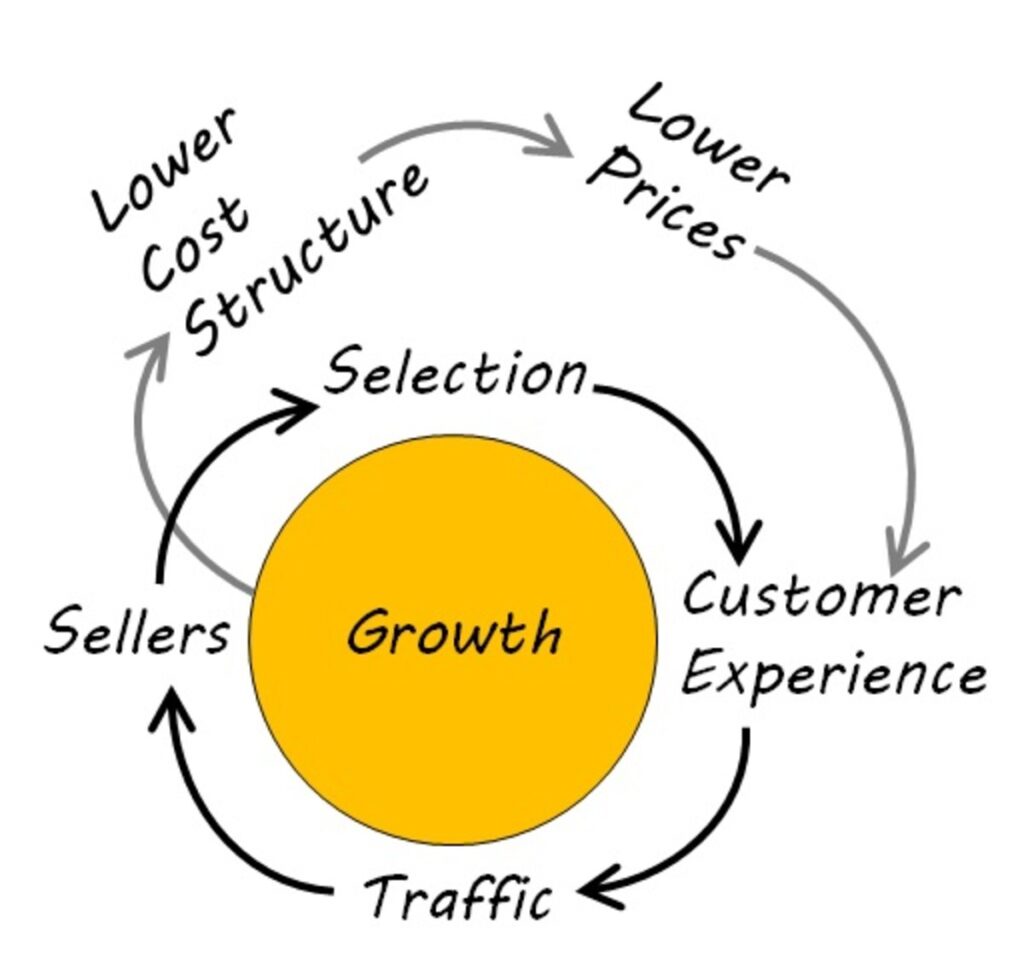

SaaS Flywheel

So SAAS is a flywheel and what is the flywheel in SAAS? In SAAS it’s about getting new customers, and getting those customers to pay you more and more over a period of time. So what they should be doing is, if they paid you $1 in month one, by month 12 they should be paying you $2 or $4 or $10.

And if you got a certain set of customers in month one that all those customers put together, let’s say they paid you hundred dollars in month one, by month 12 all those customers come together should be paying you $125 and $150.

00:36:58

So this is the first part SAAS flywheel. Second part of the SAAS flywheel is every customer who is a good customer of yours should get you one or more new customers. And what we believe is founders are able to build products in markets where this is possible. Then everything else feeds into this flywheel.

And this flywheel for SAAS is based on what Amazon has, as a flywheel. Right. And the Amazon flywheel for those who haven’t seen it, go search for it. It’s absolutely brilliant. What it allows you to do is abstract out what are the critical parts of that flywheel for your business?

00:37:27

Show Notes

Follow Upekkha (@upekkhaBe) on Twitter

Follow Maharajas of Scale on Twitter (@maharajaofscale)

Here is the Wordcloud for this episode

Books referenced in this Episode